Dubai’s major airlines say they have resumed a full flight schedule after torrential rain hit the United Arab

In an era where technology has seamlessly woven itself into the fabric of our daily lives, the travel

East Africa has been ranked among the most open sub-regions in the world in terms visa openness as

18 Apr 2024 – By Bryan Obala. In the fast-evolving landscape of travel and tourism, the role of

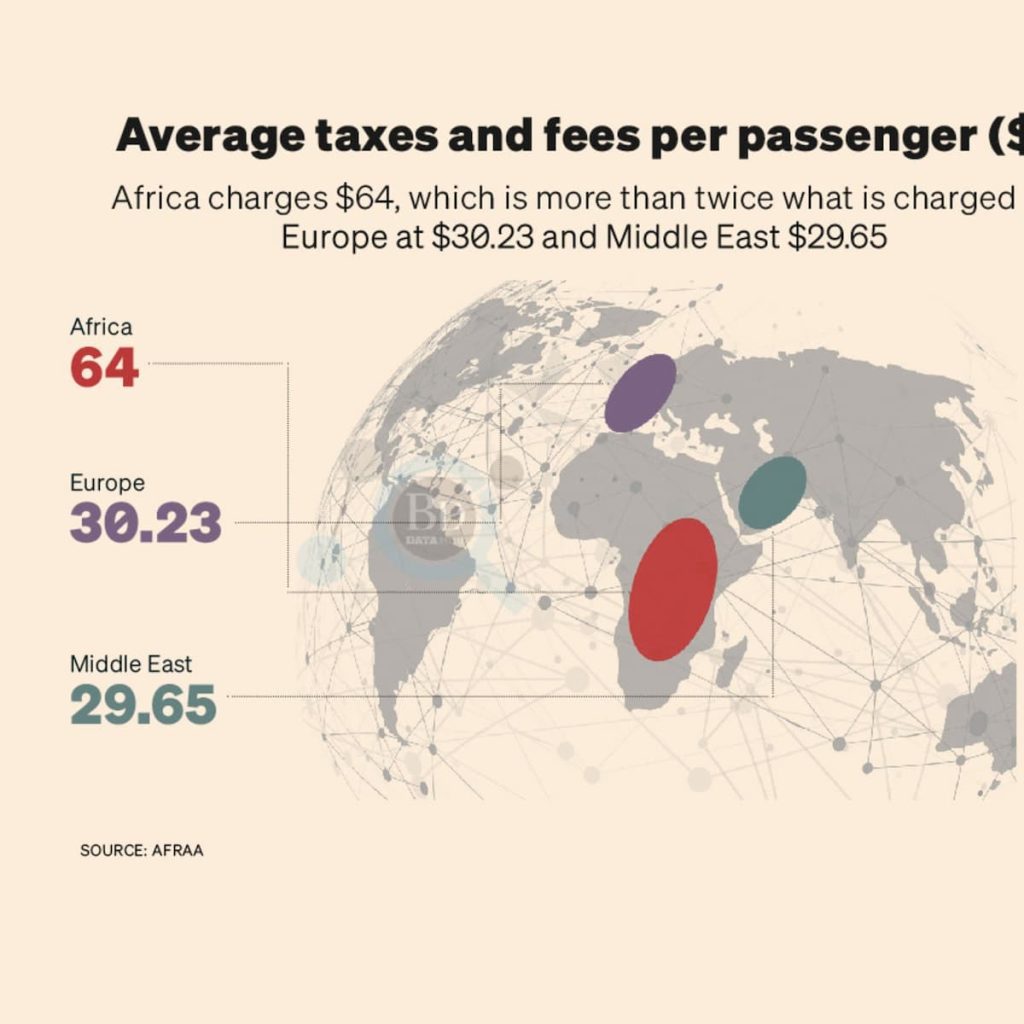

Taxes and fees charged on African air tickets are higher than what airlines in other continents charge and

The untapped potential of inclusive tourism to drive the growth of Africa’s travel industry was in focus at

SUBSCRIBE TO OUR NEWSLETTER

Join our list and stay up to date on the latest and greatest, travel news and lots of inspiration.